What Two Types of Debt Are Most Common for Millennials

The consequence of this behavior is that most millennials create a massive digital footprint online. Mortgages and car loans are among the most common types of personal secured debt in the US.

The Truth About Millennial Debt Money After Graduation

Part of the explanation for why is that previous generations tended to grow their wealth in the form of small businesses.

. Amount of money you can borrow to pay back later. Gen Z does come. What Type Of Debt Is Credit Card Debt.

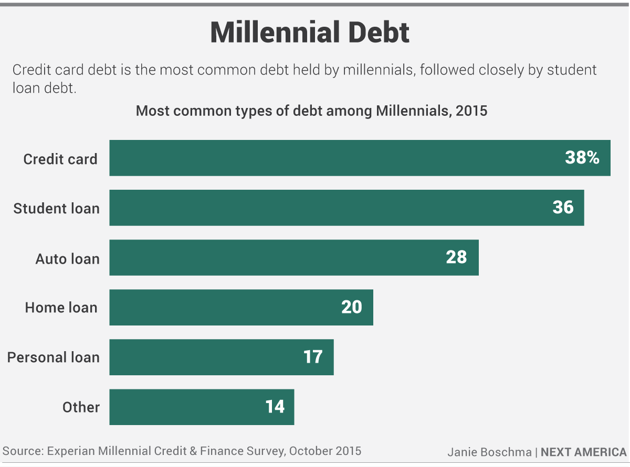

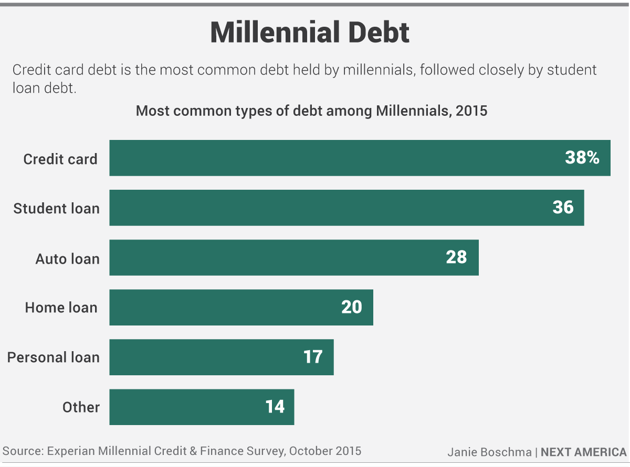

Thats in sync with Northwestern Mutuals 2019 Planning Progress Study which found credit card debt not student loans is the leading source of debt among millennials. The data are stored on a laptop computer without encryption and the laptop computer is stolen from the researchers car on the way home from work. Credit Card and Student Loan are the most common type of debt owed by Millennials.

Millennials are stressed about all kinds of debt mortgage car loans credit card and student loans. This statistic shows the results of a 2011 survey among twentysomethings also called Millennials in the United States on the kind of loan. Debt is not tied to a specific asset.

Types of debts or loans held by twentysomethings 2012. In fact millennials spend seven hours a day online according to one study. For auto loans Millennials have the fastest growth of any generation.

Undefined undefined iStock via Getty Images undefined undefined iStock via Getty Images. As mentioned above credit card debt is considered a form of revolving debt as its accumulated on a line of credit and paid off when necessary so the borrower can have. Most Common Types of Millennial Debt.

Despite credit cards being the biggest source of debt for one in four millennials about 22 dont know the interest rate theyre being charged. 70 of those in credit card debt across all generations have at least one other type of debt as well with auto loans 57 and mortgages 50 being most common while 34 also have student loans. For a majority of Millennials debt is a.

Most mortgages and car loans have interest rates fixed for the duration of the loan although some adjustable-rate mortgages are available. What two types of debt are most common for Millennials. Credit Card Debt and Education Debt are the most commons types of debts used by Millennials.

Millennials are much better savers than people from previous generations averaging 18800 in the bank compared to 16800 for Gen Xers and a measly 6600 for Baby Boomers. Millennial debt to the tune of over one trillion dollars. This Is the Type of Debt Millennials Have Millennials No.

The Two Types of Millennials and the Differences Between Them. Forty percent of millennials say their biggest source of debt is either credit cards or their mortgage not their student loans according to a new Northwestern Mutual survey. Millennials are falling behind their parents and grandparents when it comes to building wealth and saving for retirement.

Debt is tied to a specific asset that can be used as collateral and repossessed if borrower doesnt make payments. When you look closely youll find that all three of these harsh labels are connected by one nasty truth. This is an.

The property that is pledged as collateral is your house or car. Look at the bottom section labelled The average amount owed by debt type. With a huge percentage of income being directed to student.

Though around half of Gen Z consumers in the metros analyzed have credit card debt that figure jumps to. According to a study by Nitro College over 70 of millennials have some amount of credit card debt while only 58 have student loan debt. Perhaps one of the most common perceptions about millennials is that they are very tech savvy having been born into and raised in the era of the Internet.

Most Millennials come into the workforce carrying a much heavier debt burden than past generations thanks to the high cost of education. Two types of debt most common for millennials are car and education debt at 41 each not a suprise because as younger people are the most common types of debt will incur first especially education one if gonna go to college most people going to have some sort of education debt. Baby Boomers and Generation X have credit card and mortgage as the most common type of debt owed.

Their debt is also negatively impacting. What is one possible explanation. 1 life goal outranks a meaningful career owning a home and raising a family.

And while these stereotypes might be true for a small portion of millennials theyre definitely not true for all. A higher percent of Millennials hold debt than any other group except Gen X yet the average Millennial debt is lower than every group except the Silent Generation age 75. On average they owe 18201 as of Q2 2019 representing a 28 percent increase in just a seven-year period.

Twenty-three percent of Millennials say that financial stress makes them. Millennials average debt of 42000 is impacting their ability to build wealth and savings. Millennials follow the same pattern as other generations by most frequently having credit card debt followed by auto loans and student debt.

Also 23 of those with credit. Nearly 67 of millennials say they have card debt 36 student loan debt 34 auto loans 26 mortgages and 13 personal loans. Aresearcher conducting behavioral research collects individually identifiable sensitive information about illicit drug use and other illegal behaviors by surveying college students.

In fact according to the Small Business. There is no collateral that can be repossessed if borrower defaults. Student loans auto loans and credit card debt round up the top three highest forms of consumer debt excluding mortgages for Millennials.

Kgw Com Which Generation Has The Most Debt And The Worst Credit Scores Hint It S Not Millennials Bad Credit Score Bad Credit Credit Score

The Truth About Millennial Debt Money After Graduation

Are You An Average Millennial When It Comes To Finances The Atlantic

No comments for "What Two Types of Debt Are Most Common for Millennials"

Post a Comment